We use cookies to give you the best online experience possible.

By continuing you accept the use of cookies in accordance with our privacy policy.

Features

The possibilities are endless. Our platform and customer service grows with your business.

Loan Origination

Originate borrower applications via our 100% automated application. No more paper

applications!

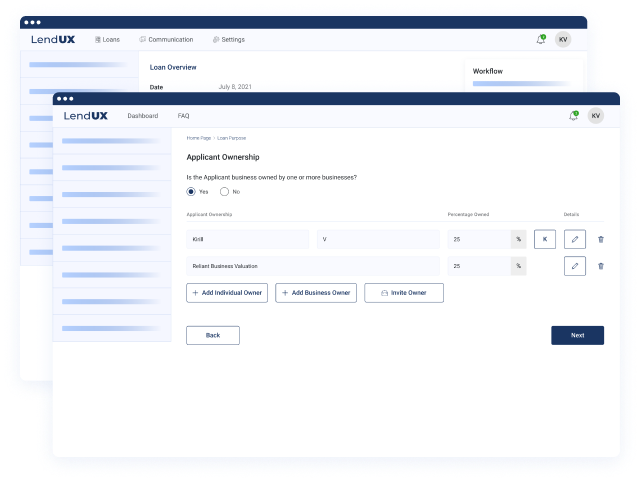

Collaborative Application

As a lender, you can view the borrower's application and edits in real time.

Co-Borrower Support

Allow multiple borrowers to work on the same application. You can also block out

specific private data so that borrowers are not privy to specific information from their co-borrowers.

Multiple Export Options

Export your fully prepared credit memorandum in word format. You will also have the

ability to export any and all data inputted by both the borrower and the lender.

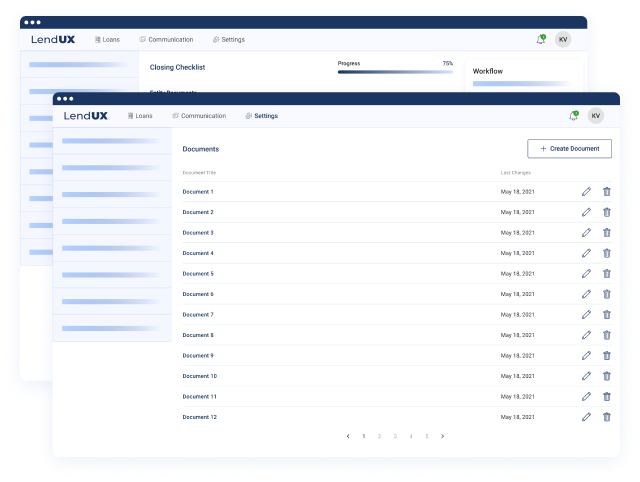

Document Management

All your documents, in ONE place. Use our document management system to store borrower

uploaded documents, as well as any lender uploaded ones.

Closing Checklist

Utilize our closing checklist to maintain a record of documents that you've received,

in addition to ones that you will still require. You can also customize the checklist to fit you and

your team's needs!

End to End Solution for Small SBA 7(a) Loans

From origination to underwriting to closing, LendUX streamlines the ENTIRE process for

SBA 7(a) loans of $350k and under.

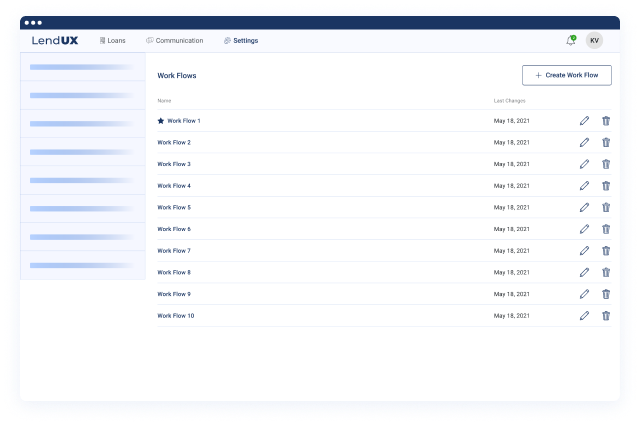

Bank Specific Workflows

Customize your own workflow; including emails, stages, checklist, and more!

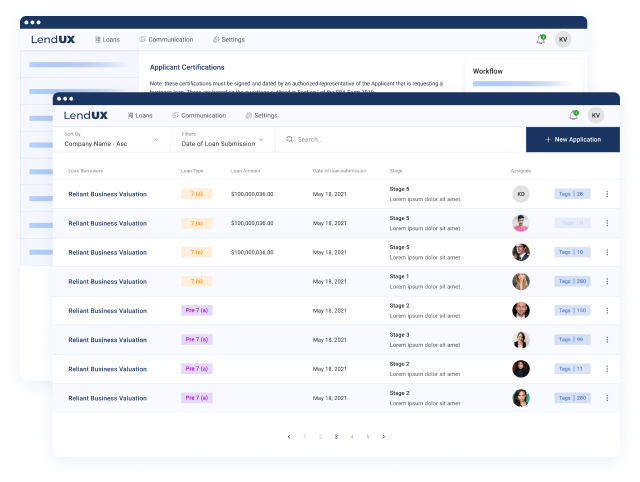

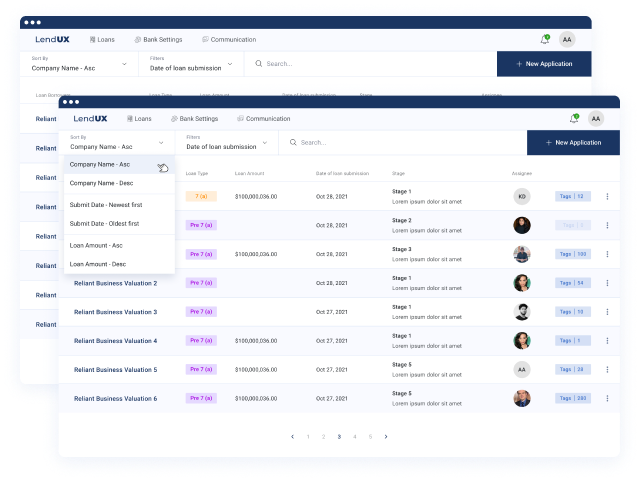

Dashboard

Customize your dashboard to your liking to view specific applications in their

respective phases/stages.

Referral Source Management

Allow your referral partners specific/limited access to your portal.

Communication Portal

Borrowers will have their communications hub to contact their respective lender. The

lender will also have their communication based portal to ensure that all communications are organized

accordingly. You will be able to send content includes documents, screenshots, and connect to the

closing checklist to ensure proper document management.

API Connections

Connect via API to DocuSign, eTran, Secretary of State, Zillow, FICO, and more!

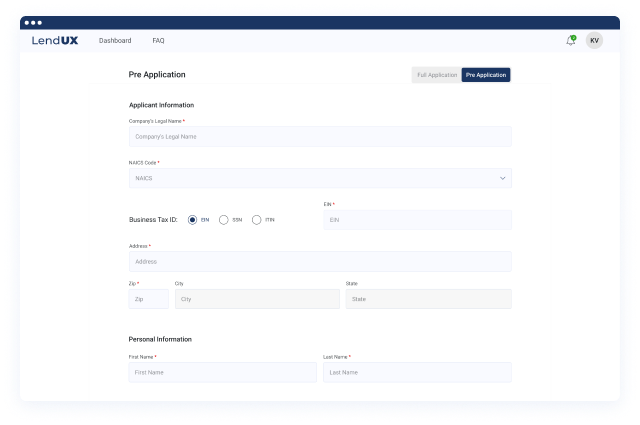

Pre-Applications

Obtain a simplified pre-application from your potential borrowers to discover if the

loan is a viable one.

Loan Tracker

Provide your borrowers with a unique link so that they can track the status of their

applications in real-time.

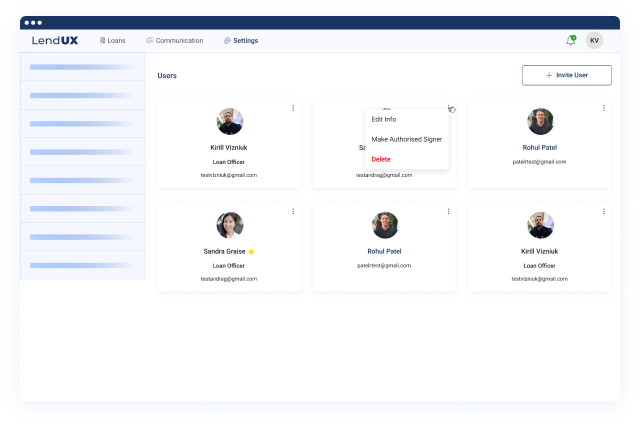

User/Role Management

Manage different lender user profiles and permissions.

Complete DocuSign Integration

Automate the entire closing process via pre-filled closing documents sent to the

borrowers via DocuSign.

Full Audit Tracking

Keep track of any and all changes made by the borrower as well as the lender. You will

also have the ability to download this audit and maintain it for your records.

(908) 888-6088

(908) 888-6088